If you were leading recruiting or talent acquisition in 2025, the year likely didn’t register as a single turning point. Employer demand didn’t disappear, and it didn’t suddenly surge. Instead, job posting activity moderated and became more deliberate.

Across the market, employers appeared to weigh talent decisions more carefully. Fewer roles were advertised simultaneously, approvals seemed more measured, and job posting patterns suggested a move away from broad expansion toward tighter prioritization. At the same time, conditions became less predictable for candidates. With fewer advertised openings and slower job mobility, competition for posted roles likely intensified, even as employers gained more time and choice in how they approached talent acquisition.

Looking back, job posting data offers a practical way to understand how this shift played out. Not as a record of confirmed hires or internal sentiment, but through the cumulative evidence of everyday signals: which roles were advertised, where demand remained active, and how much information employers chose to make public.

Hiring Didn’t Stop, It Became More Intentional

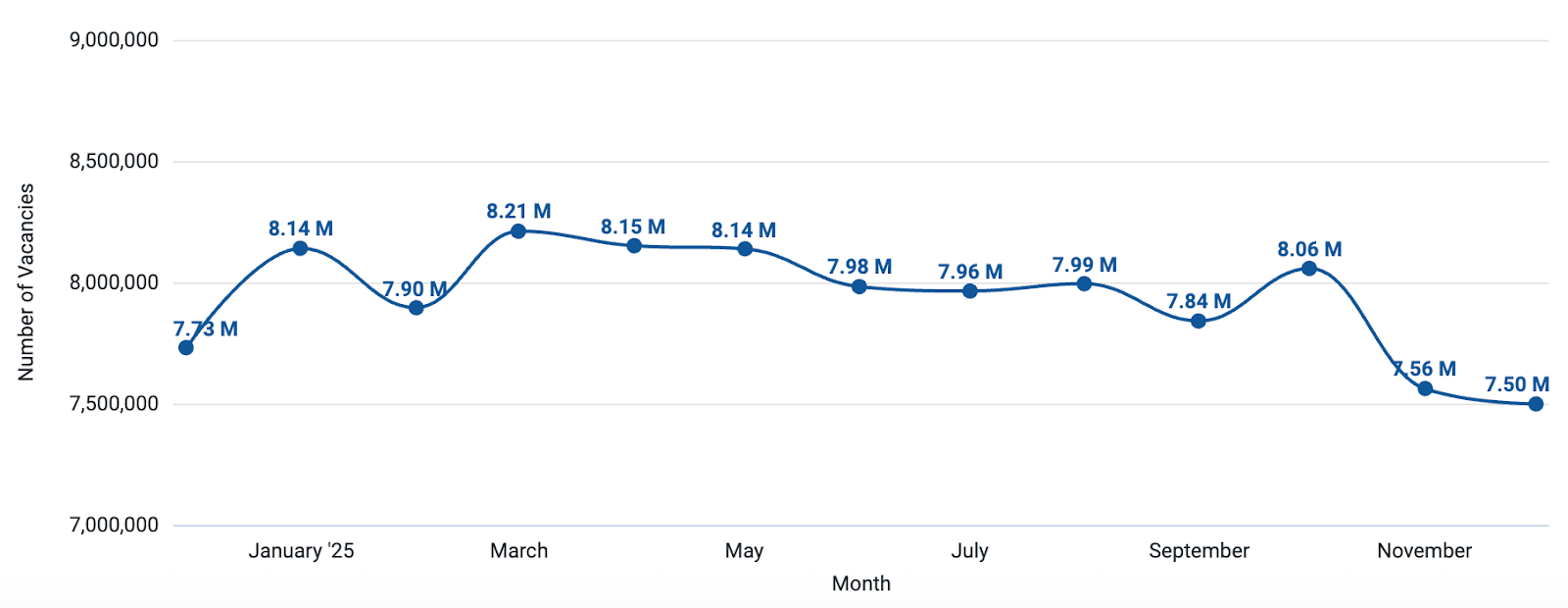

Employer hiring intent softened over the course of the year, but it never fell off a cliff. Job postings declined gradually, reflecting restraint rather than retreat. Roles continued to be advertised month after month, just in smaller volumes and with clearer business justification.

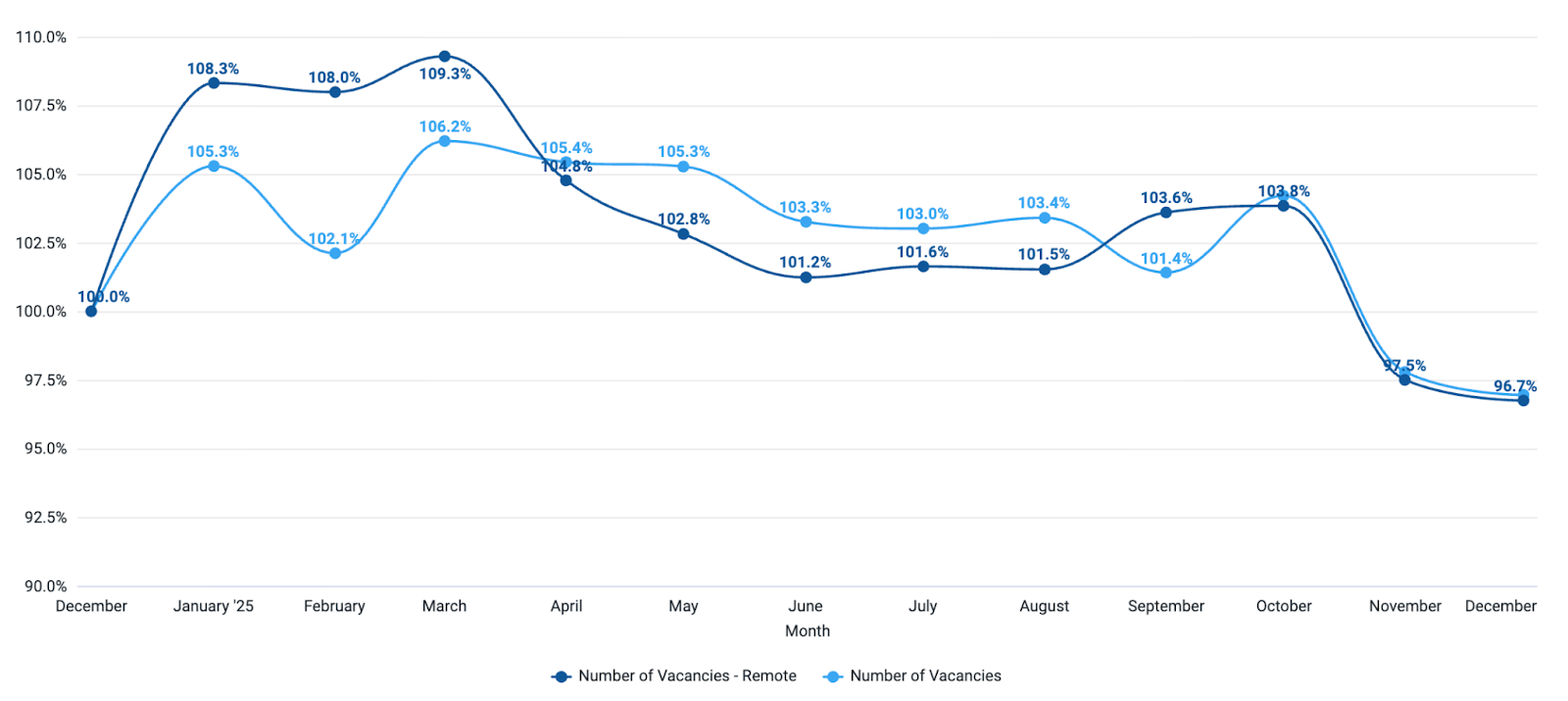

Figure 1: U.S. Monthly Job Vacancy Trend, January–December 2025

For most talent teams, this showed up as a narrower set of priorities. Fewer “nice to have” roles. More scrutiny on backfills. And a stronger expectation that every requisition had a clear line to business need. The work of recruiting didn’t go away. It simply demanded sharper judgment.

Some Roles Never Slowed Down

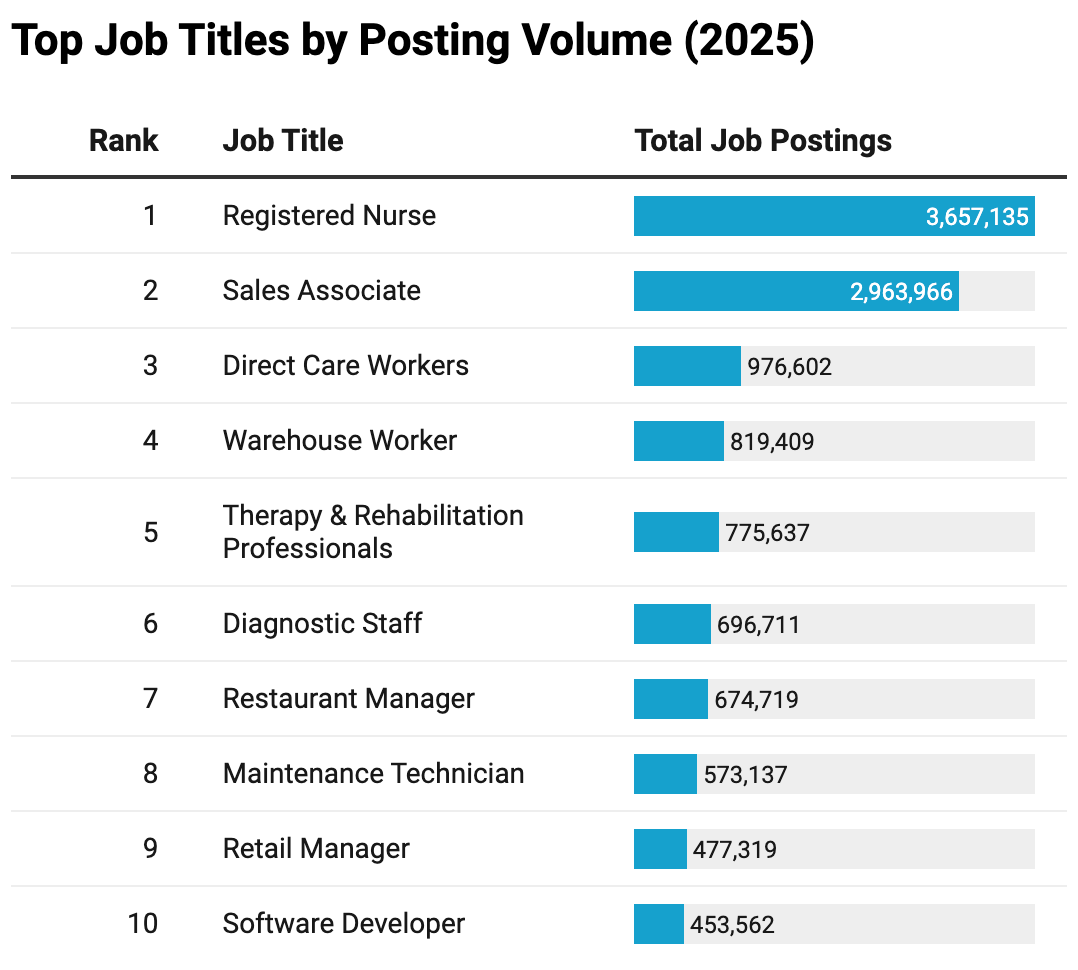

Even as overall volumes cooled, demand stayed strong in roles tied directly to keeping the business running. Healthcare, frontline, service, and customer-facing positions continued to dominate posting activity throughout the year.

Figure 2: Top Job Titles by Posting Volume, 2025

That reality created a familiar tension within TA organizations. While corporate and professional roles saw moderation in posting levels, high-volume operational roles required sustained focus. Many teams effectively operated dual models, balancing more selective professional recruitment with steady demand in essential functions.

A Subtle Shift Toward Flexibility

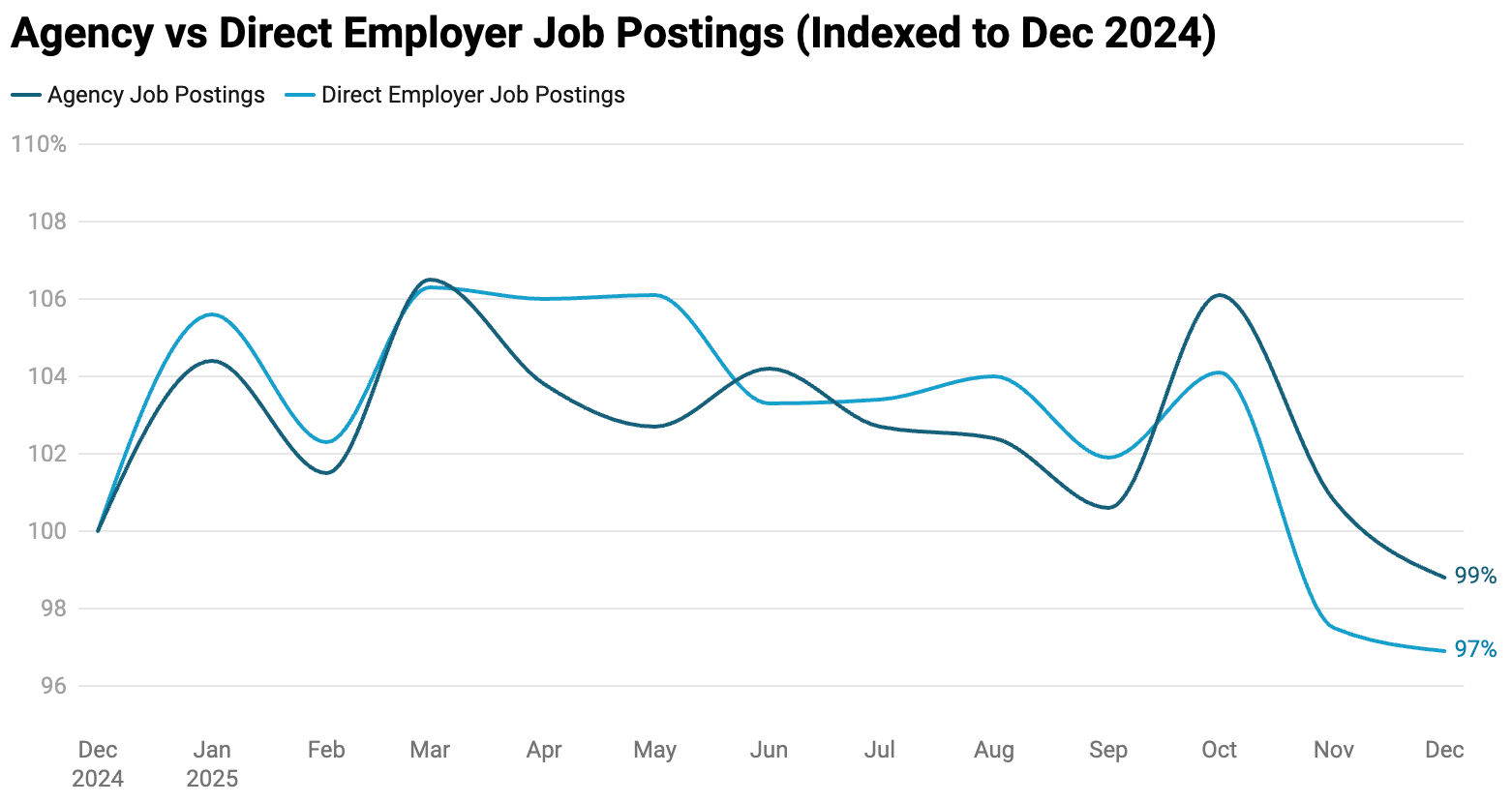

Another meaningful pattern emerged in who was advertising roles. Direct employer posting activity declined slightly more than staffing firms', suggesting that some organizations leaned toward flexibility during a period of uncertainty.

Figure 3: Agency vs. Direct Employer Job Postings Trend

For internal TA teams, this likely meant closer coordination with finance and workforce planning. Decisions about permanent headcount carried greater scrutiny, and leaders were expected to balance speed with longer-term caution.

Location Assumptions Were Tested

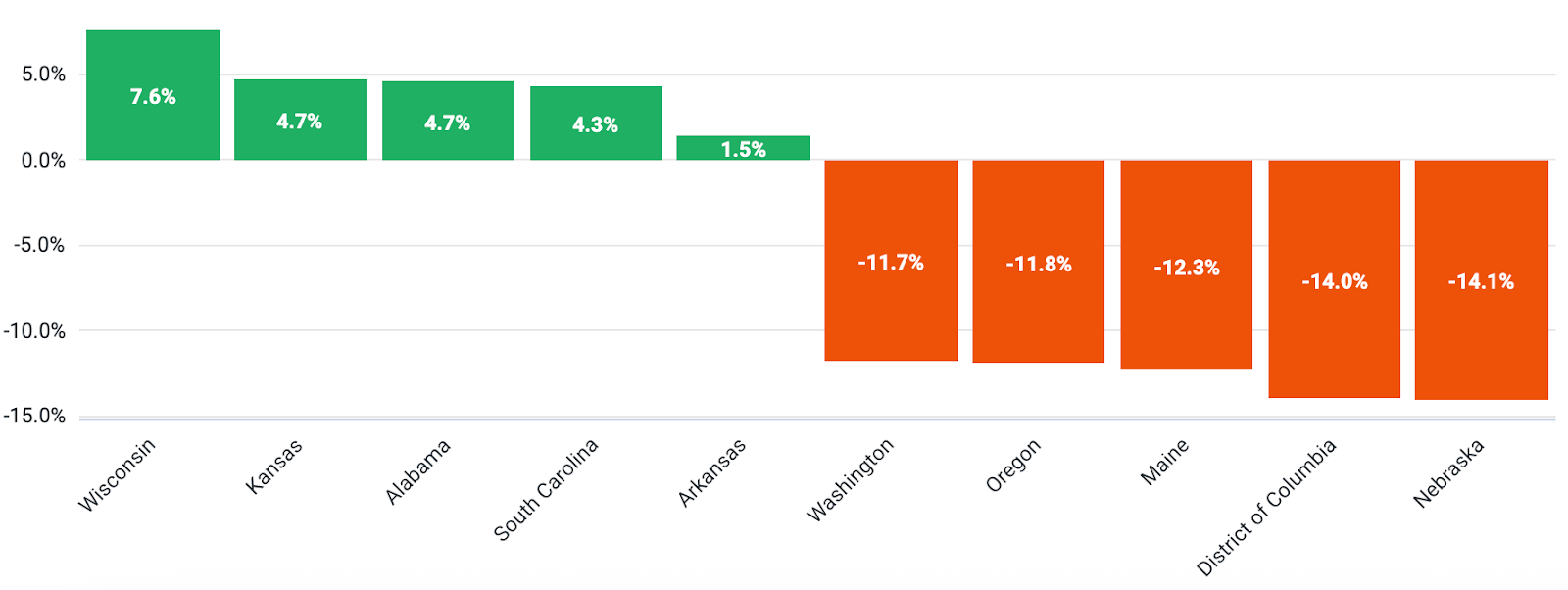

Geographic patterns added another layer of complexity. Many states and major metropolitan areas saw declines in job posting activity, while a smaller group of markets experienced growth. In several cases, those gains occurred in regions not traditionally considered primary hiring hubs.

Figure 4: Year-over-Year Vacancy Change by State

For recruiting leaders, this raised practical questions about talent availability, responsiveness, and long-standing assumptions about “core markets.” Posting data underscored the need to continuously evaluate location strategy rather than relying on historical norms.

Remote Work Found Its Level

Remote roles remained present but did not expand meaningfully. The share of remote postings remained relatively small and aligned with overall job posting trends. Where remote opportunities persisted, they remained concentrated in a limited set of professional functions.

Figure 5: Remote Vacancies Compared to Total Vacancies

Rather than signaling a reversal or resurgence, the data suggest stabilization. Remote work appears to have become a targeted lever rather than a broad strategic shift.

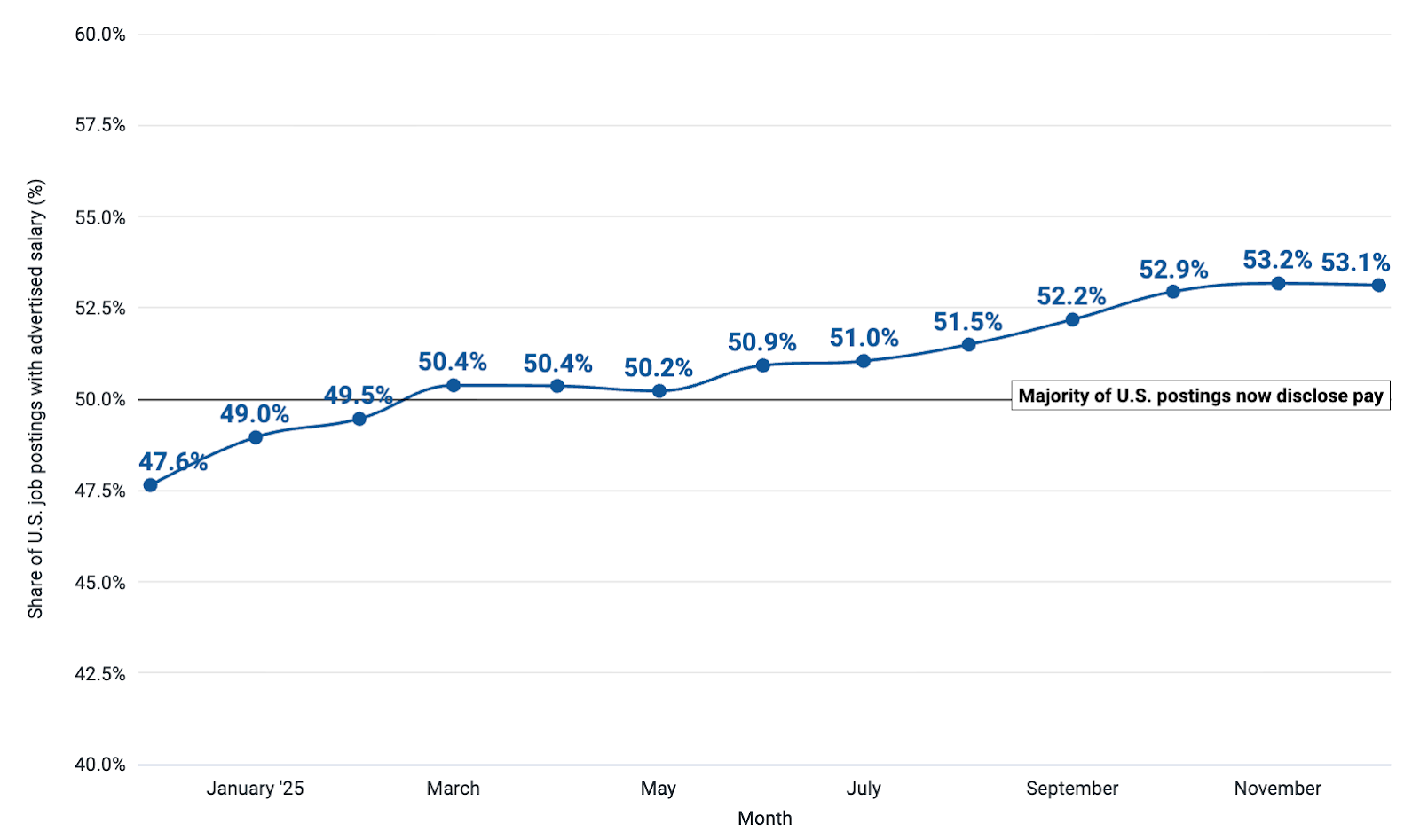

Pay Became Harder to Hide

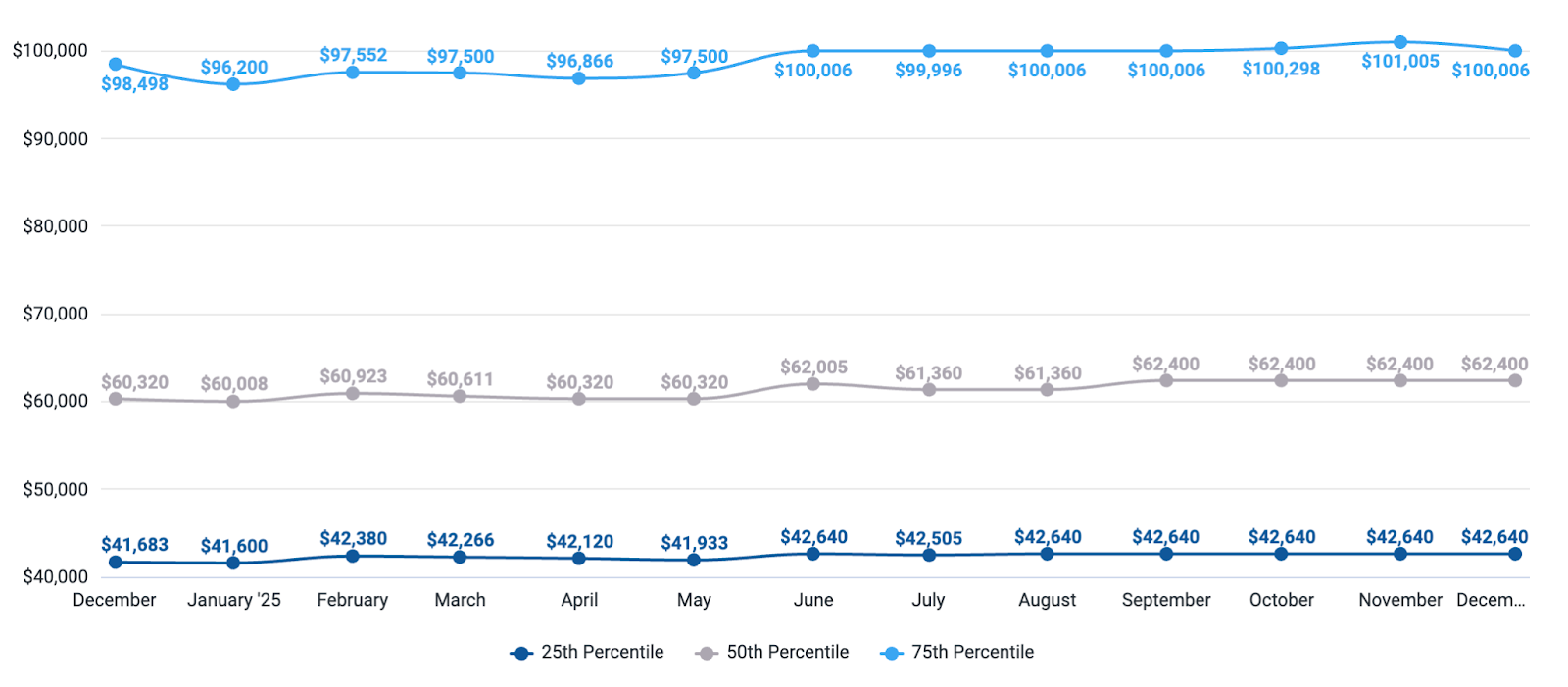

Compensation patterns reflected similar moderation. Advertised salaries rose earlier in the year and then stabilized. By December, pay ranges appeared largely steady rather than accelerating.

Figure 6: Salary Transparency Adoption Over Time

Figure 7: Median Advertised Salary Trend

More significant than wage movement was visibility. More than half of job postings now include salary information. For talent leaders, that transparency changes the dynamic. Pay ranges serve not only as internal benchmarks but also as public signals that shape employer perception and candidate expectations.

Why Employer Responses Diverged Beneath the Averages

One limitation of aggregate data is that averages can obscure variation. While overall job posting activity declined in 2025, employers did not respond uniformly. Some reduced advertised openings broadly, while others concentrated demand into specific areas they considered critical.

That divergence is particularly visible in postings tied to AI-related capabilities. Even as many organizations moderated activity elsewhere, job postings connected to building and supporting AI initiatives continued to rise steadily.

Figure 8: AI Hiring Growth

For talent leaders, the significance lies not in the headline growth but in the operational implications. Teams had to determine which emerging roles warranted investment, define them, and assess talent for work that often lacked established job architectures. In many cases, this meant revisiting skill definitions, compensation structures, and evaluation criteria.

The broader takeaway is not that posting activity increased in certain segments. It is that strategy that dictated where employers maintained intent and where they chose restraint.

Looking Ahead

What 2025 revealed was not a collapse in employer demand, but a market where intent became more deliberate and more visible. Each advertised role reflected a clearer prioritization of resources and risk.

For the CareerXroads community, the value of this data lies in perspective rather than prediction. Job postings reflect signals of intent, not confirmed outcomes. But those signals help illuminate how organizations navigate constraints, allocate talent investment, and adjust strategy in real time.

As teams plan for 2026, the lesson is not about expansion or contraction. It is about clarity. In a market where visibility has increased and movement has slowed, deliberate hiring intent matters more than volume.

Data Methodology

The findings in this analysis are based on Aspen Tech Labs’ JobMarketPulse platform, which monitors hiring activity from more than 350,000 direct employer career sites worldwide. This dataset captures a substantial share of live postings and provides near-real-time insight into employer demand. All figures reflect information published directly by employers, including salary ranges where available. All data comes from posted job requirements; salary figures should be interpreted as indicators of market trends rather than confirmed offer amounts. Changes reflect real shifts in hiring activity rather than database expansion or methodological updates.